Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 28.04.2025

EURUSD

EURUSD was little changed today, trading at $1.1352, losing by more than -1.3% last week after four consecutive weeks of strong performance. As calendar from EZ has no major releases for today, volatility is likely to remain tight. Markets still expect two or three more rate cuts in 2025 by ECB.

Technical correction would be highly probable ( ongoing now) , targeting $1.1490 then $1.1455 which exactly what happened , $1.1335 will be the next target (executed ) then $1.1270. Forecasts poll changed to bearish on weekly basis by 75% of the traders.

USDJPY

After more than 2% increase last week, USDJPY traded unchanged today at 143.66, the highest in two weeks. Last week’s strong performance in USDJPY was due to correction in USD index after heavy losses two weeks earlier, and the higher inflation from Japan that may push for higher rates ahead. USD index gained more than 1.4% last week.

Daily & hourly trend index remained bullish, heading higher to 144.20 . 142.90 is support, not a major one. 1H RSI is trading sideways now.

GBPUSD

GBPUSD started the trading on Monday unchanged at $1.3305 after it fell by -0.5% last week. Forward guidance by BoE is likely to support further rate cuts ahead in 2025, but the question: how aggressive is BoE going to be? Macros remained fragile in the UK, but inflation remained somehow sticky, complicating the mission of the central bank.

The daily trend index remained bullish , supported by price action that aims higher to $1.3340 then $1.3380. $1.3250 is support for day traders.

GOLD

After losing more than -4% last week, gold fell further today & traded weaker by another -1% at $3285 per ounce, two-week lows. It seems the pragmatism of Trump & China’s leadership may prevail which means less trade tensions, if that happens then gold may remain under huge pressure. Traders will closely watch PCE inflation numbers & US Q1 GDP numbers later this week. Higher & sticky inflation will keep the demand for gold solid.

Technical correction remained intact, targeting $3265. 1H trend index remained bearish supported by bearish attitude by the traders who showed no bullish attitude. $3320 is resistance.

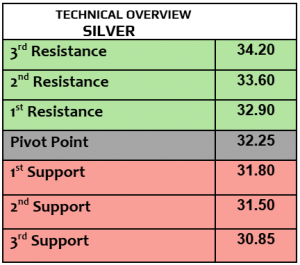

SILVER

Unlike gold, silver managed to gain last week & closed higher by 0.80% , trading slightly lower today at $32.97 per ounce. Easing the trade tensions between China & the US is likely to offer positive impact on silver’s short-term outlook. Trade disruptions & supply chain constraints will not help.

While volatility remains low, 1H trend index is still bullish. $33.50 will be the next target. $32.50 is support. 1H RSI is showing slow improvement as well.

Oil-WTI

Crude oil prices advanced 1% last week, trading unchanged today , WTI $60.03PB, Brent $66.88 PB. Between OPEC+ more oil supply, ongoing talks between Iran & US, and the pressure on Russia – Ukraine to make peace deal, oil markets are likely to remain highly exposed to these major factors. US GDP growth in Q1/2025 will be important for oil markets later this week.

1H RSI remained neutral, but forecasts poll indicated to bullish attitude by the traders without bearish nets. $64.20 is the next target, $61.80 is support.

DAX40

German DAX index gained today by 0.55% after closing higher by almost 5% last week, outperforming indexes in France 3.5%, Spain 3.2% & UK 1.3%. DAX traded at 22300 this morning. Autos & tech companies were the top performers. Airbus traded higher today at 1.6%, BMW 0.29%, Mercedes 0.71% and SAP 1%.

Hourly & daily trend index remained bullish with uptrend chart that is still heading higher slowly. 21800 is support, 22600 is the next resistance.

NASDAQ

US stock futures traded lower today after strong performance last week with SPX 6.8%, Dow Jones 4.9% & Nasdaq gained more than 8%, eliminating the losses triggered by Trump’s sweeping tariffs ate the beginning of April. Busy week ahead with first quarter earnings reports including Apple, Amazon, Microsoft and Berkshire Hathaway. It is still early to say that the traders felt comfortable as politics remained major catalyst in traders’ improving risk appetite in the last week, which means that the recovery could be fragile.

Price action is heading higher today ( correction) & targeting 18100 then 18350, both are executed then 18900 ( executed as well ) then 19400 ( approaching) . 18500 is support. 1H RSI is overbought now. Volatility remained high.

BITCOIN

BTC traded higher today at $94780, after strong performance last week & gained by more than 8% , followed by 15% in Eth, 16% in Cardano, & 12% in Ripple. According to Crypto news, Pro Shares set to launch three XRP ETF’s on April 30, the daily trading volume for XRP increased by 67% to $4.2 billion showing that the activities gained momentum.

$91900 & $86800 is support; however, markets’ sentiments still support further advance to $90600 ( executed ) , then $94K ( executed as well this morning ) then $95500. Hourly & daily trend index remained bullish.