Weekly Outlook

Weekly Market Overview: Trade War Intensified

What a week !! Last week was one of the most aggressive & volatile weeks in the history of global markets, it started aggressively on Monday where the US equity indexes tumbled by more than -5%, continuing the strong volatility throughout the week & ended higher by another 5% in SPX , Dow Jones & Nasdaq, followed by positive closing in German DAX , FTSE100 , France & Spain stock indexes as well.

Stock indexes : Trading Economics

Stock indexes rose today on Monday after President Trump decided to pause tariffs on mobile phones & consumer electronics, this pause on smartphones are most of which made in China. President Trump imposed 145% tariffs on China’s exports to the US, China retaliated by imposing tariffs on the US imports to China by 34% before increasing again to 84% then 125% , that was the turning point for the markets, traders & policy makers. It was very clear that Trump aimed to weaponize the tariffs & use it as negotiation tool for higher maneuvering with China. America has more than $300 billion in trade deficit with China .

In the meantime, USD index – DXY fell today to 99.35, the lowest level in three years, USD index aggressively fell last week & lost more than -3.5% as the trust in the US assets , USD-denominated investment & White House policies diminished. It is good to know that Trump targeted weaker USD since the US election campaign last November, but such a drop has not given the right message Trump wants. It simply represents the loss of confidence in USD , pushing traders to bet higher on Yen , EUR & CHF that gained 3.3%, 4.4% & 4.9% respectively in the last week against USD.

Chart : Bloomberg

The chaos in US bond markets was notable as well, after yields on the US bonds kept climbing , showing that the appetite for US safest assets weakened with weaker demand, not to forget that the higher the yields , the higher the burdens on the US government that must re-pay trillions of dollars by the end of 2025 due to the maturity of its bonds. High yields on the US bonds indicated that the traders were still expecting higher inflation rates ahead, which is going to be another dilemma for the Federal Reserve. It is good to know that the higher the yields, the cheaper the bond prices are going to be , but the question: will you buy these bonds ?

Meanwhile, the chaotic politics in the White House, loss of confidence in USD and rout in US bond markets supported EUR as the main beneficiary of USD weakness . EURUSD rallied by more than 4% in a week, the fastest rally in a decade & half, trading today at $1.1391, the highest since January 2022. Another beneficiary in G10 currencies was the Japanese Yen that rose by 3.2% vs USD in a week. Yen benefited from being safe-haven currency, highly demanded amid markets’ turmoil. If BoJ decides to increase the rates later, Yen’s bullish performance may continue. Chart: Bloomberg

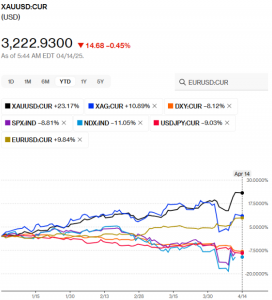

As the chart above shows, gold is still trading at record-high not far from all-time high ( $3243 per ounce) . Gold increased by 23% YTD, up by more than 35% YoY, outperformed on yearly basis silver 11.7%, WTI -14%, SPX500 7% , Nasdaq 7% , German DAX 16%, FTSE100 2.3%, EURUSD 7% and USDJPY 7.2%. Four consecutive months of the strong performance that made gold one of the best performing assets in 2025 and reflecting a fact that the confidence in monetary policies & fiat money diminished.