Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 13.11.2024

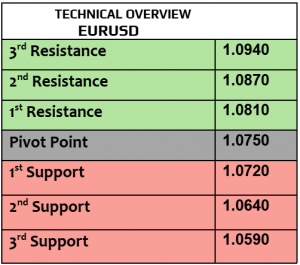

EURUSD

After three consecutive days of loss, EURUSD was little changed today, trading at $1.0619, the lowest since April 2024 as USD strength remained intact. EUR weakness was due to the political instability in Germany and weaker economic sentiments in EZ this November, not to forget that the next step by ECB is to reduce the rates. What’s next for EUR will depend on USD index, and more macros from EZ that remained fragile.

Price action & 1H chart are still giving bearish behavior which means that the correction to $1.07 (if happens) could be short-lived.

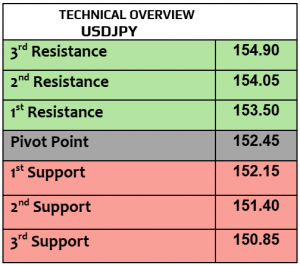

USDJPY

USDJPY traded higher today at 154.82, the highest since last July where the USD index maintained its bullish performance and Japanese officials have not yet taken further actions to stop Yen weakness. In the meantime, Japan’s PPI in October increased by 0.2% MoM, 3.4% YoY, higher than the estimates, PPI shows the inflation in goods & production sector. Higher inflation may result in BoJ intervention to stop Yen’s excessive weakness, so be prepared.

153.50 & 152.15 are important support (1H chart) for day-traders. 1H RSI is approaching from overbought level, but price action is still positive.

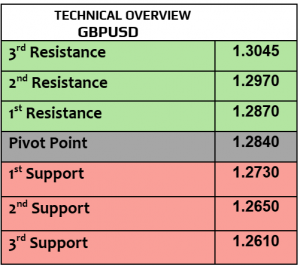

GBPUSD

Higher rates in the UK than other advanced economies failed to support the Pound in the last three days, trading today vs USD at $1.2745, three-month low. Unemployment in the UK increased to 4.3% in September from 4% in August, while the average hourly earnings increased by 4.8% in September, higher than the forecasts, so what does that mean? It simply means that BoE is having big dilemma with high-sticky inflation & weaker job market, causing what we can call stagflation. BoE monetary policy report hearings will be due later today.

1H RSI is totally oversold; correction may target again $1.2820.

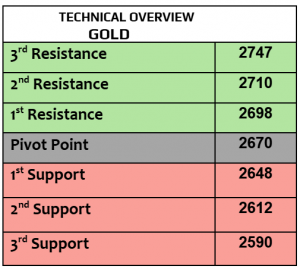

Gold

Everyone is asking, is the selloff in gold going to stop after three consecutive days of heavy loss by more than 3%? Gold is trying to recover this morning, trading higher at $2608 per ounce, still at the lowest in one month. While gold fell by more than -1.5% in a month, the trend of gold will remain highly correlated to two major factors, Fed rate decision with US inflation, and China’s data that kept giving bearish mode about growth & inflation that fell in China by -0.3% in October. Keep an eye on the US CPI numbers later today.

It is a mixed sentiment now, after being oversold, traders started buying from $2590 but price action is still fragile. $2625 is the next target

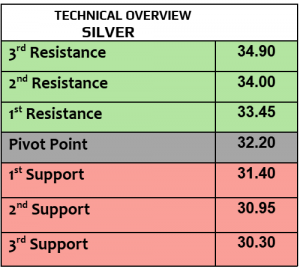

Silver

Silver traded higher today at $30.96 per ounce amid profit taking after three days of loss. Even if China announced 10 trillion Yuan package to support the economy, the attention would remain on Trump’s next tariffs on Chinese products & exports. More tariffs could lead to further losses in silver, so keep an eye on the economic developments from the US new administration.

According to price action, traders are targeting again $31.40 before the pivot, however bullish bets are not yet fully materialized.

.

.

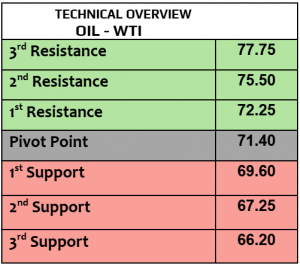

Oil – WTI

Crude oil prices traded slightly higher today, WTI $68.33PB, Brent $72.12PB. OPEC reduced its global oil demand forecast for 2024 & 2025 due to China’s slowdown, China is the World’s biggest oil importer. The worst is yet to come in oil markets, mainly because of Trump’s oil policies, if Trump decides to support the American oil industry & pushes for higher production then oil will remain under huge pressure. API will release the US weekly crude oil inventories later today.

Price action is giving further weakness with low volatility. $68.90 then $70.45 are the next targets. No sustainable bullish bets yet.

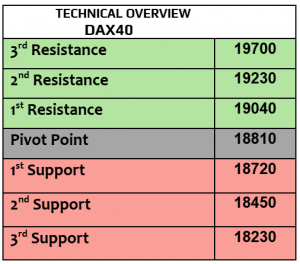

DAX

DAX futures were little changed today after DAX tumbled by -2% on Tuesday to 19034, following other European equity indexes that fell in Spain, Italy & France. Economic sentiment in Germany worsened in November, Germany’s inflation remained unchanged in October at 2.4% and the political instability continued, so all bad things come together in Germany now. Yesterday, Siemens lost 4.2%, Airbus -3.6% and major auto stocks fell as well.

Markets’ sentiments changed quickly, targeting now 18900 (profit-taking). If DAX doesn’t fall below 18900 then it has higher probability to recover.

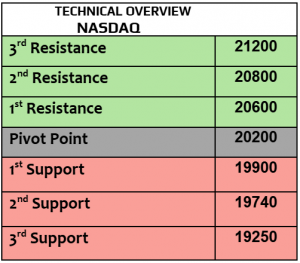

Nasdaq

US stock futures traded slightly weaker today after Nasdaq slightly fell on Tuesday, Dow Jones lost -0.86% & SPX declined -0.29%. All markets’ participants will focus on today’s inflation numbers from the US, CPI is likely to increase to 2.6% in October. The higher the inflation, the higher the rates are likely to stay for longer. Weaker inflation in the US is likely to be positive for the US equities.

After being totally overbought, profit taking started, targeting now 20900 amid low volatility.

BTCUSD

What a rally in crypto market. It was impressive in both, BTC price that has a new record-high at $90K, and crypto market cap that increased to $3 trillion, the highest since 2021. Major cryptocurrencies are falling today, BTC $87200, Eth $3171 & Solana $206. Bitcoin is still up by 15% in a week, Eth 17% & Cardano 48%. Crypto-friendly environment by the incoming administration in the US was the major catalyst in this impressive rally. Trump said before that he wants to make the US the crypto capital of the World.

Profit-taking would be highly expected, targeting $86100 then $84K. Trend & market sentiments remained bullish.