Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 14.11.2024

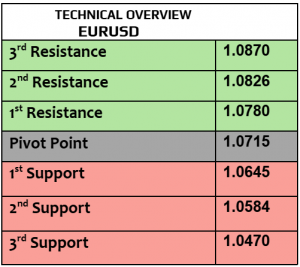

EURUSD

Five consecutive days of negative closing, EURUSD fell further today to $1.0543, the lowest since October 2023 as USD index strength continued, DXY traded higher today at 106.72, the highest in a year. Macroeconomics from EZ remained weak, while the US inflation increased by 2.6% in October which means that the Fed is unlikely to cut the rates quickly. EZ GDP for the third quarter & industrial production will be due later today.

As said before, sentiments remained bearish with falling price action to new lows. $1.05 is not far from execution. $1.0590 is short-lived resistance.

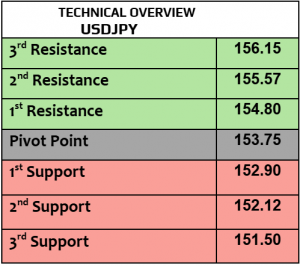

USDJPY

USDJPY traded higher today at 155.97, the highest since last July, supported by higher bond yields from America & DXY strength. While there was no news from Japan, it is highly expected that BoJ & Japanese officials will start the verbal intervention first as long as Yen weakness persists. Yields on 10Y bond in the US increased to the highest level since June 2024.

As clarified, price action remained positive. Keep in mind, 155.35 & 154.50 are support levels. Markets’ perception aims higher to 160 (June 2024).

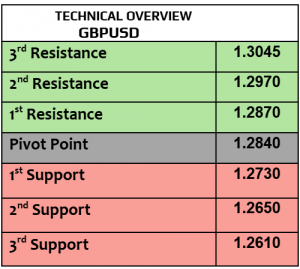

GBPUSD

GBPUSD kept falling for five consecutive days, trading lower today at $1.2687, the weakest since last August. Did we have any major news from the UK? Actually, there was no major releases from the UK while the focus was on the US inflation numbers that remained elevated. BoE’s governor Bailey will deliver speech later today, but it is unlikely to be a game changer.

Even if 1H RSI was somehow oversold, it failed to support the buyers. Price action is still showing further drop to the last major support. $1.2725 & $1.2750 are short-term targets (resistance).

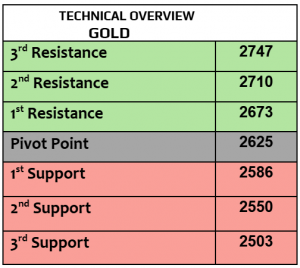

Gold

Gold lost -5.4% in a week, the worst weekly loss since June 2021, trading today at $2558 per ounce, the lowest in two months. High inflation from America is a double-edged sword for gold traders, gold remains one of the best assets to hedge against inflation, and at the same time, as long as the US inflation remains elevated then the Fed may not cut the rates soon, that’s not positive for gold’ bulls. Keep an eye on the US PPI numbers later today.

Markets’ sentiments remained negative with bearish behavior that is still betting on lower level to $2500 after it broke the 2nd major support (was vital).

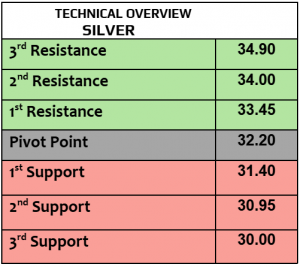

Silver

Silver was even worse than gold in its weekly performance after silver fell by almost -6%, trading today at $30.07 per ounce, two-month low. China’s PPI & CPI were weaker in October than September, it was big hit for demand outlook. PPI from the US will be next. If Trump’s proposed plan works well & US manufacturing improves then the demand for silver may strengthen.

Gold/silver ratio still shows that silver is undervalued. Daily chart is totally bearish, edging lower to the last support then $29.50. $30.40 is resistance.

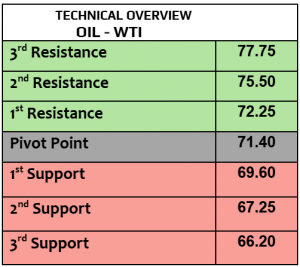

Oil – WTI

Crude oi prices fell today, WTI $67.97PB, Brent $71.81PB. According to API, US crude oil inventories fell by 0.77 million barrels last week, EIA will release the weekly inventories later today. In the meantime, EIA raised its 2024 global oil output forecast. Oil markets are likely to remain affected by China’s short-term outlook, and Trump’s oil policies that aim to increase the American oil production. US PPI numbers will be due later today.

1H RSI is sideways with $67 support, and $68.80 resistance amid slow volatility.

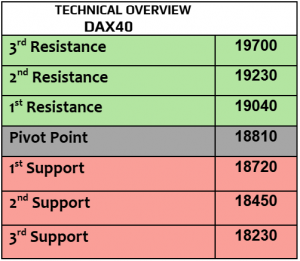

DAX

DAX index fell on Wednesday by -0.2% to 19003, DAX futures are falling now as well. Germany is still facing political instability, while the traders remained anxious about Trump’s tariffs measures that may hit EZ products & exports. We watch closely GDP numbers from EZ later today.

Price action is mixed, but the market’s sentiments were somehow bearish. 18900 is support, 19100 is resistance. Further correction will not be a surprise.

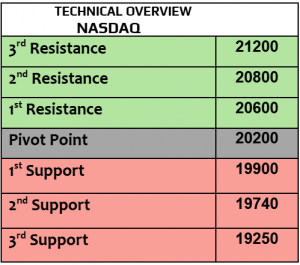

Nasdaq

US stock futures traded lower today after Nasdaq fell yesterday by -0.26%, Dow Jones gained 0.11% and SPX was almost flat. US inflation figures in October met expectations, but still higher than the Fed target of 2%. In the meantime, markets are likely to watch PPI numbers & initial jobless claims later today, not to forget the daily updates from president-elect Trump about his economic agenda & new cabinet names.

After being totally overbought, profit taking started, targeting now 20900 amid low volatility.

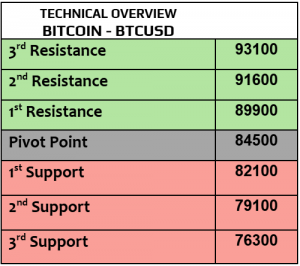

BTCUSD

Bitcoin slightly fell today to $89900 after hitting new record-high at $93K. Other major cryptocurrencies traded higher today, Eth $3220, Cardano $0.5843 and Solana $219. Crypto market cap is approaching again from $3 trillion, with BTC stands for $1.77 trillion, followed by $387B in Eth and $126B in Tether.

Profit-taking would be highly expected, targeting $86100 then $84K. Trend & market sentiments remained bullish. Technical channel remains bullish, supported by traders’ behavior.